The Process

By contacting Mensh Insurance via email, phone or via the website, you can begin to explore your supplemental individual Disability Insurance options. By completing the quote request form there is no cost or obligation to work with Mensh Insurance or to purchase any insurance policy. However, by providing Mensh Insurance with the requested details, we can prepare individual proposals to show you how much individual disability insurance you might qualify for in addition to the group protection you already have or as your sole means of protection.

How much can I buy and what will it cost?

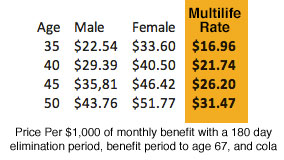

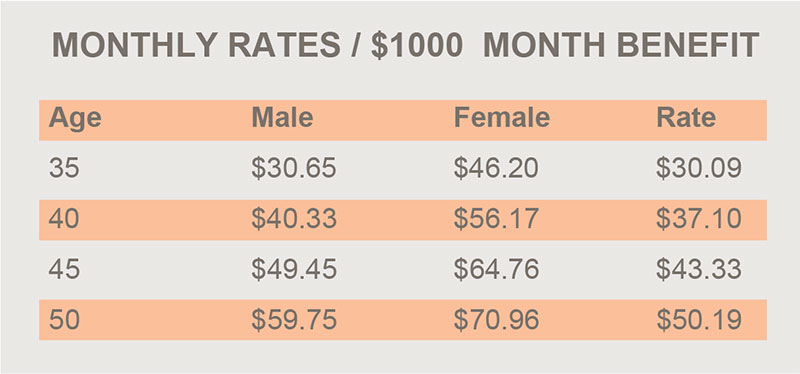

When evaluating Individual disability insurance rates, you will find that premiums for males are generally 20-30% less expensive than female counterparts. Under this new program for Cornerstone Health employees, we are able to bring a single discounted rate for all employees. Not only does this help males, it saves the greater percentage for all females compared to what you will find from the same insurance companies outside of this program. The chart below provides examples of monthly costs at ages 35-50 for males and females and the advantageous Cornerstone Health employee rates. These rates reflect own occupation, residual, and cost of living increase riders. Individual plans can be tailored to fit your needs with or without some of these riders and with other riders such as a catastrophic benefit in the event of a long term care situation prior to age 67.

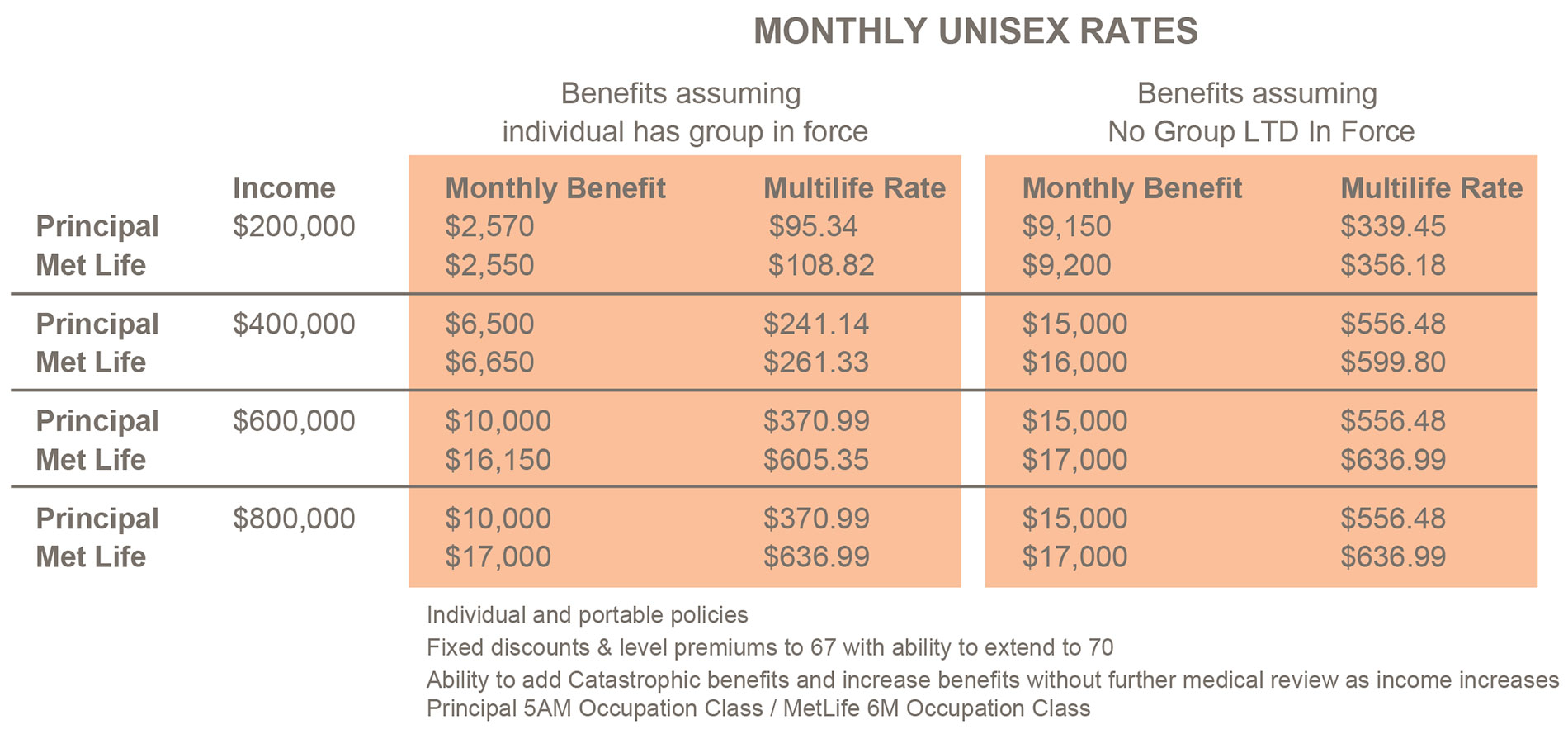

Many of you will participate in the group Long Term Disability Insurance program that replaces 50% of your income up to $15,000/month. However, under this special individual supplemental plan, you have options via several carriers to secure even more income protection. The following charts provide an example for a male or female, age 40 at various incomes and what you are eligible to purchase with or without participating in the group program. Remember, the industry norm is to insure 50-60% of one’s income...the individual plans allow for slightly higher protection with fixed portable premiums.

Why Mensh Insurance for these policies?

Based on 40 years of experience in the medical marketplace and specializing in supplemental individual disability insurance, Mensh Insurance can bring you the top insurance contracts from the best companies in the industry. Nationally recognized carriers such as Principal, MetLife, Guardian, and the Standard have enabled Mensh Insurance to assist medical societies, private practices, and hospitals over the past four decades. At this time, Mensh Insurance has negotiated significant discounts for Cornerstone Health Care employees that are not available elsewhere. Bringing these comprehensive and discounted plans together for your review and comparison simplifies your planning process and allows you to make an educated decision concerning your insurance portfolio.